Structured Note Exchange

Home

Portfolio Manager Investment Oversight & Planning

Role

Product Designer

Timeframe

2025-Ongoing

Domain

Pre-Trade/Post-Trade

Tools

User Interviews, Figma, Miro, Material UI, MUI Data Grid, Notion

Helping portfolio managers scale their business by allocating Structured Note exposure across many accounts while staying within firm guardrails, issuer limits, and strategy rules.

Context

Context

An opportunity to innovate how Wealth Managers, particularly SMAs, juggle Billions in AUM across hundreds of client portfolios.

Allocation decisions for Portfolio Managers of Separately Managed Accounts are made under complex, firm‑specific rules (issuer limits, exposure targets, Note Type constraints). Today this is manual and error‑prone, slowing trades and risking violations. Teams need a transparent, scalable way to monitor accounts, surface risks, and produce a compliant booking plan at trade start.

Portfolio Strategy

Create Rules

Build custom categories, populate definitions, set limits

Setup Accounts

Contract value, overrides, portfolio value

Input Notes to Buy

Assign priority, assign Issuer, categorize

Allocation Execution Plan

How much of each Note can I buy for each account?

Research

Research

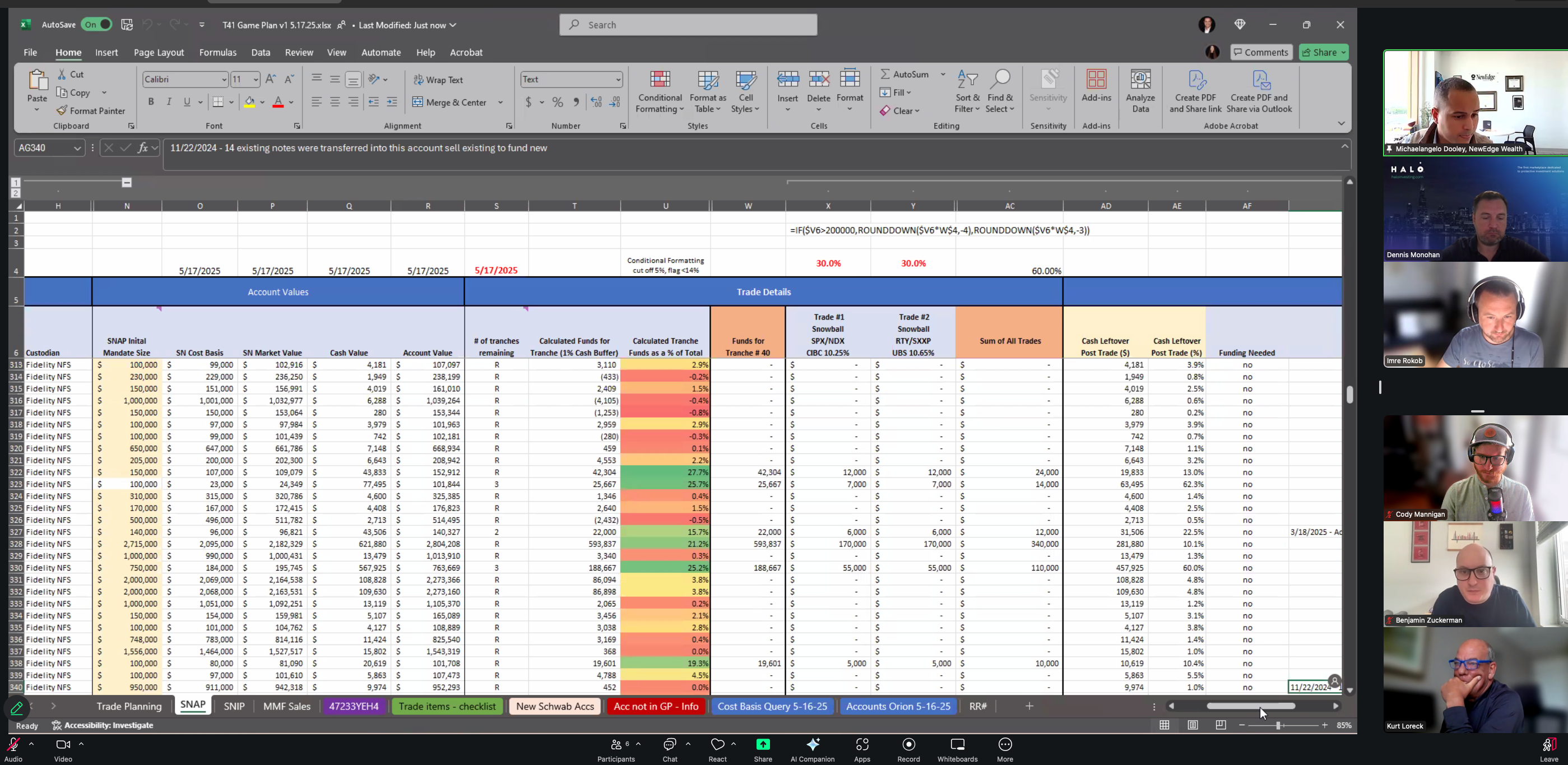

Insight 1: spreadsheet purgatory

We sat with desk operators and Portfolio Managers to hear their current process: juggling spreadsheets and manual tracking.

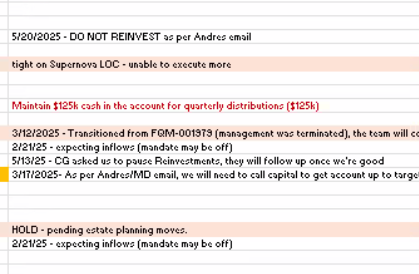

Tranching added crucial nuance. Many firms deploy cash over time—often four tranches of roughly twenty‑five percent—so the real question wasn’t “how do we fully deploy?” but “how much should we deploy now?” Rules that mattered most were consistent across firms: single‑position caps, issuer concentration, underlying exposure targets, and note type constraints. We also heard the non‑negotiable: the system should never book something invalid. But trust grows when experts can override with a clear rationale. Finally, leaders wanted a monthly, portfolio‑level pulse: are accounts trending healthier or drifting toward risk?

Manage multiple accounts in different stages of investing (tranches) and different investment restrictions.

Stay on top of account health so violations never surprise the team.

When a trade is about to start, produce a booking plan that is both compliant and easy to explain.

Manage multiple accounts in different stages of investing (tranches) and different investment restrictions.

Portfolio Manager

Goal: Scale business to thousands of clients.

Stay on top of account health so violations never surprise the team.

Portfolio Manager

Goal: Avoid TRACE and FINRA violations

When a trade is about to start, produce a booking plan that is both compliant and easy to explain.

Portfolio Manager

Goal: Centrals trade complexity.

Solution

Solution

Creating the Rules Engine

Portfolio Managers can utilize default categories or create their own custom ones. Within a category, they will define limits and thresholds which keep client accounts from breaching composition limits. This should be a one-time exercise per portfolio strategy.

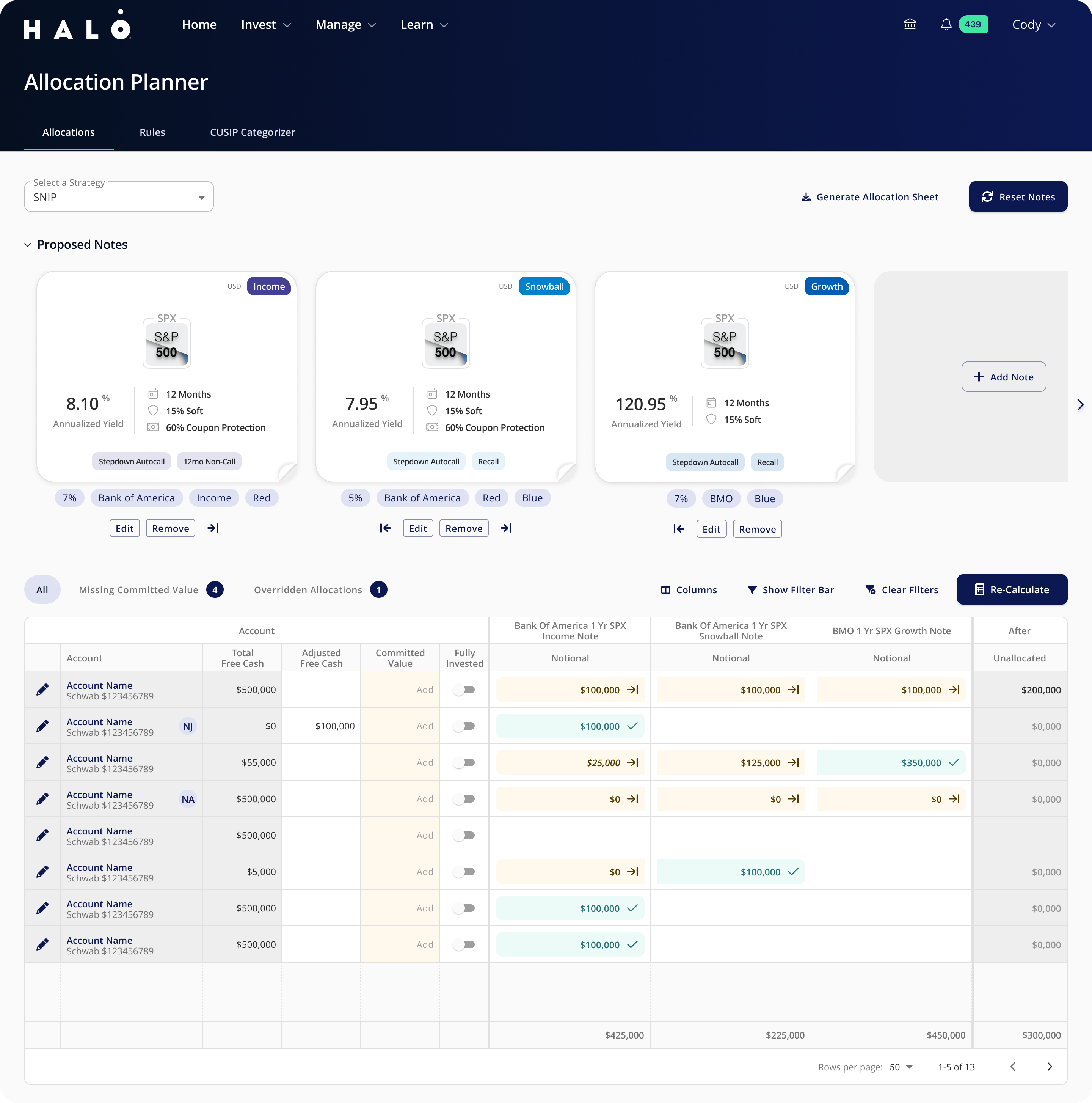

Building a Trade Plan

Portfolio Managers will mostly live on this screen for repeated trade activity. When they find Notes that they’re ready to buy, they will add them to the Proposed Notes section, and then add a few extra criteria. The system will run account-by-account to tell them exactly how much they can invest in each account. Ultimately, they will export an easy spreadsheet to send to the trade desk and their Custodian.

Categorizing Existing Assets

Since some Assets will not be automatically assigned to custom categories, an Analyst will need to go through and assign CUSIPs to custom categories for them. This will need to be done once on the entire book of business, and then after each trade.

Outcomes

Outcomes

This feature is still in development, so far we have only been able to do reviews of the design with Portfolio Managers but feedback has been positive.

If given more time, I will be adding ongoing portfolio management to help Portfolio Managers keep their ongoing portfolios balanced in between trades.